This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Holistic Site Selection and Facility Design Help Deliver Overarching Supply Chain Strategy: Part 2

In my previous post, I explained how DCS ensures that your new facility will be in the right place, based on a host of supply chain strategy, operational needs, and infrastructure factors. When — as part of a holistic site selection and design approach — your goals are best met by relocating to a new location or adding another facility to your network, DCS partners with Colliers, an international commercial real estate brokerage and advisory firm.

We work closely with Todd Steffen, Executive Vice President of Supply Chain & Real Estate Advisory Services at Colliers. Together, we help customers find the right facility that meets not only their need for space, but also addresses other critical requirements.

In this blog, Todd shares the key factors to consider as part of a holistic site selection and facility design approach. He advises focusing on the availability of suitable real estate, transportation costs, and how work will be done in your facility.

Consider Overall Costs When Evaluating Facility Options

When considering overall supply chain costs across retail, distribution, wholesale, and manufacturing operations, Todd notes that rent typically averages 5% of the total.

“On the other hand, depending on the location, transportation can be anywhere from 20% to 40% of total costs. Likewise, labor can be 15% to 30% based on the type of operation. E-commerce is going to be more labor intensive than a pallet-in/pallet-out process, for example,” he explained.

Therefore, what dictates where a facility should be located is often inbound and outbound transportation costs, and labor availability.

Inland Ports Mitigate Limited Availability, Inbound Transportation Congestion

For most warehousing and fulfillment operators, outbound transportation costs usually outweigh inbound by 4:1. When considering how to keep inbound transportation costs in check for heavy importers, it may make sense to choose a location as close to a port or rail hub as possible. That can maximize the number of drayage deliveries a facility can receive in a day.

Yet, notably, the Colliers’ report found that the areas with the lowest vacancies include Greater Los Angeles, Savannah, and Seattle/Tacoma. There’s also essentially no space left to build close in to seaports either. For that reason, Todd noted, port authorities and economic development agencies in those regions are working to further develop what’s known as inland ports.

Inland ports typically connect by dedicated rail line to the primary port. This allows train transport of unloaded shipping containers to warehouses and distribution centers located in a less crowded area. While it does add time to the inbound receiving process, that lag is negligible because it significantly cuts down on having to deal with trucking congestion in the primary port area.

Todd pointed to the Appalachian Regional Port in northwest Georgia and Inland Port Greer in South Carolina as prime examples of successful industrial square footage development. “These areas were not previously considered prime industrial land, but they accommodate construction of 500,000 to 1 million square foot facilities and keep containers flowing through the ports more efficiently,” he said.

That makes inland port facility locations worthy of site selection and facility design consideration when looking for additional square footage or transloading locations.

Flexible Automation Supports Throughput Demands

While transportation and real estate availability are near the top of the list of factors to evaluate when locating an operation, another key consideration is the labor shortage that exists across North America. To address this ongoing dilemma, more and more tenants are evaluating and deploying automated solutions. New construction that integrates the design requirements of future automation can often make implementation of automation faster, less costly, and less complex, Todd added.

“Today’s warehouse occupants want higher ceilings, maximum space between columns, and maximum electrical power capacity,” he said. New, Class A facilities that accommodate those needs are more desirable than retrofitting an existing space — which can take more time.

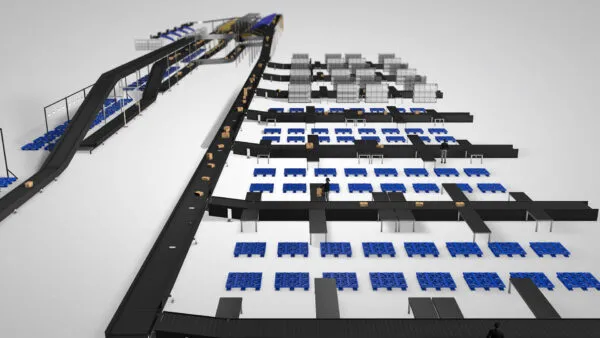

Increasingly, DCS recommends flexible solutions that are not permanent installations. Indeed, many of today’s preferred automation solutions differ significantly from those of even two decades ago. Fixed automation — such as crane and aisle-based automated storage and retrieval systems (AS/RS), for example — is both time- and capital-intensive. As an alternative, DCS frequently advises customers to consider:

- Autonomous mobile robots (AMRs or “cobots”) follow zone-based pickers as they select items to fill orders. When the required picks are complete, the first AMR departs to transport the picks to a consolidation area, while a second AMR takes its place.

- Goods-to-person AMRs transport totes of required items to associates assigned to dedicated picking workstations in a goods-to-person methodology. This eliminates travel time completely and increases productivity dramatically.

- Cube-based and shuttle-based AS/RS are high-density, grid-based systems that deploy robots that travel on top of or within the storage system. They extract totes of stored items required for picks and deliver them to goods-to-person workstations where associates select the needed items.

“These newer automated systems and many others can often draw on existing power infrastructure. That allows an operation to consider what might otherwise have been less desirable, Class B or C space, and still be incredibly productive without needing a massive infrastructure investment,” Todd said.

Our experience at DCS has proven these newer automation solutions make employees’ jobs less physically taxing and more appealing. This helps to attract and keep new employees, while increasing productivity with an existing workforce.

Considering a New Facility? Talk to a System Integrator First

Working with the right system integrator and site selection expert ensures that your new facility will be in the right place, based on a host of supply chain, operational, and infrastructure factors. It also delivers flexibly designed facilities that form the foundation of your long-term success.

Whether you’re building greenfield or seeking a leased facility, a system integrator like DCS — working with a trusted partner like Colliers — can help accelerate the site selection and facility design process to maximize your return on investment while minimizing commissioning time. For more information about how holistic site selection and facility design can help deliver on your overarching supply chain strategy, connect with us, or reach out directly to me at gary@designedconveyor.com.

AUTHOR: Gary Church, Strategic Accounts, Senior Executive, gary@designedconveyor.com