As part of the operational assessments performed by DCS’ consulting team for clients, we conduct a thorough and systematic review of their data. It’s remarkable how much insight we can glean into an existing operation simply by analyzing their inventory and order datasets. In today’s warehousing and distribution operations, where reliable labor is hard to come by and more facilities are considering automated solutions, warehouse data analysis can help us pinpoint the optimal mix of automated technologies, as well as identify areas for process improvements.

Analyzing Different Datasets Paints a Fuller Picture

To gain the best understanding of a warehouse or distribution center’s current situation and what type of automation might be most effective, we analyze several different types of data and its subsets.

Order history, preferably for the past year, allows us to identify periods of high, low, and average demand. We examine the number of lines in each order, how orders flow throughout given time periods (daily, weekly, monthly, seasonally), and more.

Concurrently, we evaluate inventory snapshots to determine each item’s velocity. That is, how quickly does it move through the warehouse. Typically classified as A, B, C, or D movers — A being products ordered the most often, D being products ordered rarely — the speed with which each stock keeping unit (SKU) moves can identify optimal candidates for automation. For example, inventory that moves extremely quickly isn’t ideal for automation, but rather should be placed in forward pick zones for maximum efficiency. Likewise, the slowest movers that are rarely ordered are a better fit for distant static storage locations.

We also assess data about each product and its characteristics. Specifically, the weight of the unit, dimensions, color, and any other characteristics such as special handling requirements. Knowing this information helps to determine the size and scale of an automated solution. It also helps to identify products that are not suited for automation, such as hazardous materials.

Data Analysis Looks for Both Anomalies and Routine Patterns

One of the most enlightening warehouse data analysis methodologies we employ is graphing. Spikes in volume literally appear as spikes in a graph. Seeing an anomaly — or any departure from the norm — calls for a deeper dive into the data to seek out the explanation.

Sometimes an unexpected volume spike ties into weather trends. A hardware distributor, for instance, may suddenly begin shipping a significantly larger number of snow shovels and ice melt granules in January because of a forecasted blizzard. Conversely, a significant spike can simply be a clerical error. For example, a customer meant to order 80 bolts, but accidentally ordered 800,000. Although the operation addressed the issue that day, the original order remained in the system of record.

In addition to anomalies, we also look for the routine. When sizing an automated system, it’s important to understand the average daily throughput, as well as the average peak demand. That way the automation can be right-sized, meaning built to accommodate those standard deviations.

A material handling system designed solely to handle average demand will ultimately not be scaled to adequately handle peaks. On the other hand, a system designed to handle the highest demand peaks will result in equipment underutilization most of the time. The operational data analysis helps us identify the appropriate balance.

Warehouse Data Analysis Helps with Automation Justification

With warehouse labor so difficult to attract and retain, sometimes operations managers fantasize about housing all their inventory in a single automated system with picking workstations staffed by robots. Based on their data, we can quickly generate a scenario that meets that objective, along with an informed cost estimate based on DCS’ experience with multiple technologies and vendors.

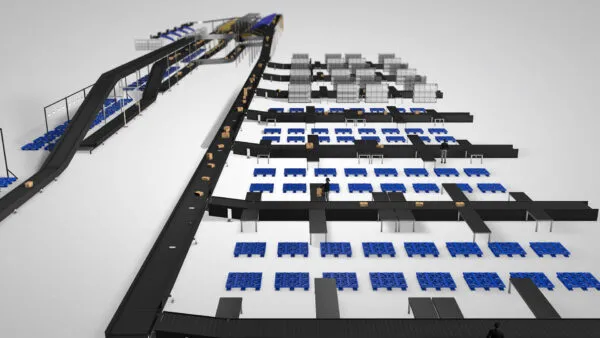

Unfortunately, most companies’ budgets can’t accommodate a system like that. However, that doesn’t mean automation is off the table. Rather, the data analysis enables us to optimize an automated system by identifying which SKUs are best suited for different equipment, based on their order profiles and characteristics. Often applying automation to a specific subset of an operation’s inventory enables it to increase throughput and efficiency to the degree that mitigates staffing challenges.

Further, sometimes a process change can yield significant productivity gains — either in conjunction with an investment in automation, or instead of one. By observing employees as they work through tasks, we compare their productivity against time measurement standards. Based on these labor models we determine how long a process should take, as well as how many staffers are needed to complete it depending on order volume and its fluctuations through different periods of time (days, weeks, months, years). In addition to studying their associates as they work, we also talk to them. Often some of the best ideas for improved efficiency come from workers themselves.

Depending on these process observations, backed by what we’ve gleaned from the data, we can best advise a customer on the optimal mix of automated solutions and process modifications to achieve their efficiency and productivity goals.

Engage Waller & Associates for Consulting Services

Wondering what operational improvements might be hiding in your data? Waller & Associates, a subsidiary of DCS, offers comprehensive warehouse data analysis paired with the insights gleaned from 90-plus years of hands-on expertise. Let us leverage your data to help you achieve higher levels of operational performance, efficiency, and profitability. Connect with Waller & Associates today to learn more about putting our warehouse automation consulting and operational data analysis services to work for you.

AUTHOR:

Anne Gupta

Supply Chain Engineer

anne@designedconveyor.com